Click on the screen you wish to view, or scroll down to view all:

| Consumption |

|

Summary |

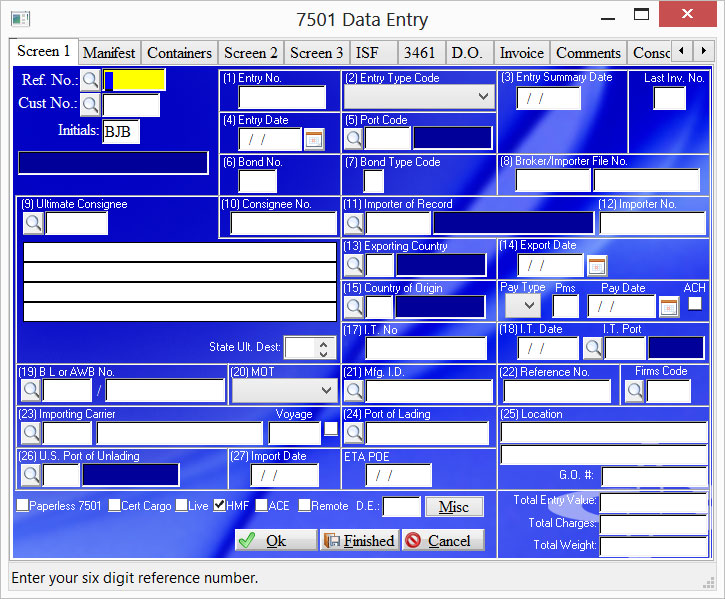

The 7501 program has been enhanced to make data entry easier and more efficient. There are a few things you should remember while keying. Yellow fields indicate where the cursor is located. Tab to advance to the next field, shift+tab key to back up just like normal windows. To save a screen you must click Ok or the information will not be saved. There are also certain fields that have custom right-click pull down menus for your convenience. |

To Key 7501:

- Click Import, 7501 Processing, (1) Key 7501 into print file or Quick #3

- Enter all of the data you need and click Finished when completely done.

The first screen of our 7501 is where you begin all references. Notice that most of the fields match the actual 7501 form. It is MANDATORY that you input the reference, customer and initials to edit any of the screens.

|

Field Name |

Description |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Ref. No.: |

Enter your reference number or click the look up button. This field has a right click option that allows for Inquiry, Computer Assign Ref, Clear screen, Delete, Print and Change customer number. This field is mandatory. Right Clicking this filed will allow the option of: Inquiry-You can pull up the Print File and search a particular reference Computer Assing #-If the feature is set up in CBCC, it will use the next available Ref Number New Entry-Will Clear the screen and allow you to start a new file. Delete -You have the option to Delete the 7501 out of the Print File Print-Will pull the 7501 print file and allow you to select a file for Printing CF-7501 Change Customer #- this allows you to change a customer number if it was originally keyed incorrectly. Copy a Reference-You can copy a previously keyed 7501 and change info for this new file. Print SEB- This will allow you to Print a Single Entry Bond Directly from the 7501 Scan Documents - Opens scan documents program Select a template - opens template program for creating new or selecting Create for ABI - Creates file into vpn for ABI |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Cust. No.: |

Enter a valid customer number or click the look up button to select one. This is part of the key to a reference and should not be changed once the file has been entered. Right click for more options. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Initials: |

Enter your initials. This field has become mandatory for creation of entries and other functions. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(1) Entry No.: |

This number is created from your reference number as a base and calculates the correct check digit. You may also enter your own number. Detailed instructions concerning the entry number are contained in Customs Directive 3500-08, dated June 19, 1986, (Customs), and Customs Directive 3500-058, dated September 10, 1991. An entry number, in this format, is required on all broker/importer prepared informal (which require a CF 7501) and warehouse entries. NOTE: If for some reason the entry number is incorrect. Clear out the field and let the computer recreate it based on your reference. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(2) Entry Type: |

Select the appropriate entry type code by selecting the two digit code for the type of entry summary being filed. The first digit of the code identifies the general category of the entry (i.e., consumption =0, informal =1, warehouse =2, etc.). The second digit further defines the specific processing type within the entry category. Therefore, a consumption quota entry should be recorded under code 02, an informal free or dutiable entry under code 11, etc.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(3) Entry Summary Date: |

This block is to record the date the entry summary is filed with Customs (six digit numeric code showing month, day, and year - MMDDYY). The record copy of the entry summary will be time stamped by the filer at the time of presentation of the entry summary. In the case of entry summaries submitted on an ABI Statement, only the statement is required to be time stamped. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Last Inv. No | Enter the last invoice number sequence to avoid extra questions at the end of entry. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(4) Entry Date: |

Record the six digit numeric code: month, day, and year (MMDDYY). Normally, it is the date the goods are released except for immediate delivery, quota goods, or where importer/broker requests another date prior to release (see 19 CFR 141.68). It is the responsibility of the filer to ensure that the entry date shown for entry/entry summaries is the date of presentation (i.e., the time stamp date). NOTE: This date is needed to calculate the pay date. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(5) Port Code: |

Enter the four digit numeric code of the |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(6) Bond No.: |

Record the three digit numeric code that identifies the surety company on the bond. This code number can be found in block #7 of the Customs Form 301/Customs Bond. This code number is also available through ACS to ABI filers, via the importer bond query transaction. For U.S. Government importations and entry types not requiring surety, the code 999 should appear in this block. When cash or Government securities are used in lieu of surety, use code 998. This is the customers bond number and should not be changed. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(7) Bond Type: |

This is the customers bond type and should not be changed. Record the single digit numeric code as follows: |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(8) Broker/File No.: |

Enter the broker's file number or importer's reference number. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

9) Ultimate Consignee: |

Enter a valid customer number for the Ultimate Consignee. For a period of 90 days from the date of issuance of this directive, record the name and address of the individual or firm for whose account the merchandise is shipped. If this information is the same as the importer of record, leave blank. Effective on the 91st day from the date of issuance of this directive, record the name and address of the individual or firm purchasing the merchandise or, if a consigned shipment to whom the merchandise is consigned, or if those parties are not known, to whose premises the merchandise is being shipped. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(10) Consignee No.: |

Record the IRS, Social Security, or Customs assigned number of the consignee. This number must reflect a valid identification number filed with Customs via the CF 5106 or its electronic (ACS) equivalent. When the consignee number is the same as the importer of record number, the word "SAME" may be used in lieu of repeating the importer of record number. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(11) Importer Record: |

Enter a valid customer number for the Importer of Record. The importer of record is the individual or firm liable for payment of all duties and meeting all statutory and regulatory requirements incurred as a result of importation. Use the 5106 program to add importers into Customs system. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(13) Export Country: |

Enter the exporting country utilizing the two character alpha ISO country codes specified in the International Standard ISO 3166 (a list of the ISO two character alpha codes is provided as Appendix C in this issuance). If you are using |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(14) Export Date: |

For merchandise exported by vessel, record the month, day, and year on which the carrier departed the last port in the exporting country (format: MMDDYY). |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(15) Country Origin: |

Enter the country of origin utilizing the ISO country codes specified in International Standard ISO 3166 (listed as Appendix C in this issuance). If you are using |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Pay Type: |

Select the payment type. This should default from the customer master but can be overwritten. 1- Non Statement 2 - Broker 3 - Importer 5 - Imp Rec w/ suffix 6 - PMS Broker 7 - PMS Importer 8 - PMS w/suffix |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Pay Date: |

Enter the payment date or use the # button to calculate the paydate you have chosen in your master file maintenance. Eight days or more is recommended. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

ACH: |

Check here to indicate ACH payment. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(17) I.T. No.: |

Record the In-bond Entry Number obtained from the CF 7512C or, if applicable, the air waybill number. If AMS Master in-bond movement (MIB), record the 11 digit in bond number obtained from the AMS carrier. Neither the CF 7512 or CF7512C are used for the AMS master in-bond program. If merchandise moves on an I.T. into a Foreign Trade Zone, do not record that number on the CF 7501 when the merchandise is removed from the zone. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(18) I.T. Date: |

Record the date (format MMDDYY) of the In Bond Entry Number (CF 7512) or if applicable, the Transit Air Cargo Manifest (TACM), or the AMS Master in-bond movement. Note: I.T. date cannot be prior to import date |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Enter a valid I.T. port. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(19) BL or AWB No.: |

Enter the number assigned on the manifest by the international ocean or air carrier delivering the goods to the |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(20) MOT: |

Select the method of transportation by which the imported merchandise entered the *Note - Selecting mode 40 or 41 will turn OFF the HMF flag. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(21) Mfg ID: |

This block is provided to accommodate the manufacturer/ shipper identification number. This identifies, by a constructed code, the manufacturer/shipper of the merchandise. For the purposes of this number, the manufacturer should be construed to refer to the invoicing party or parties (manufacturers or other direct suppliers). The name and address of the invoicing party, whose invoice accompanies the Customs entry, should be used to construct the I.D. The method for deriving this number as contained in Customs Directive 3500-13, November 24, 1986, entitled "Instructions for Deriving Manufacturer/Shipper Identification Code", is included in this issuance as Appendix B. The manufacturer/shipper identification number is required for all entry summaries and entry/entry summaries, including informal entries, filed on the CF 7501. When merchandise is imported from

*NOTE: You can use a default MID if you enter it into the customer master.

This field also has an auto-fill feature so that if you put in the first 7 characters and hit tab it will search the manufacturer file for matching MID's and display them for you to choose.

Right Clicking this field will allow you to: Look Up ID- Search your MID Files for existing MIDs you have on file Query ID thru ABI-Will Transmit and MID query with your entry to ensure it is on file with CBP Update Entry with ID-This will update the Entry with the MID you have selected. Add to Master-This will add this MID to your CBCC MID File.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(22) Reference No.: |

Enter the IRS, Social Security, or Customs assigned number of the individual or firm to whom refunds, bills or notices of extension or suspension of liquidation are to be sent (if other than the importer of record and if the CF 4811 is on file). For correct format of number, see instructions under "Consignee Number". Do not use this block to record any other information. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Firms Code: |

Enter a valid firms code. Note: This field has an auto-fill feature so that if you put in the first few characters and hit tab it will search the firms code file for matching codes and display them for you to choose. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(23) Importing Carrier: |

For merchandise arriving in the

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Voyage: |

Enter the voyage number with out the V-. The 7501 print program adds that for you. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(24) |

For merchandise arriving in the U.S. by vessel, record the five digit numeric code listed in the Department of Commerce Schedule K for the foreign port at which the merchandise was actually laden on the vessel that carried the merchandise to the U.S. (NOTE: A January 1, 1991 edition of the Schedule K listing is included in this issuance as Appendix E). If the foreign port of lading is not provided for by name in the Schedule K, use the code for "all other ports" for the port of foreign lading for the country.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(25) Location: |

Where the entry summary serves as entry/entry summary record the pier or site where the goods are available for examination. For air shipments, record the flight number. Where FIRMS codes are available, they may be used in lieu of pier/site. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

G.O. #: |

In the case of merchandise placed in general order, record the number assigned by Customs in the following format:

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(26) Port of Unlading: |

For merchandise imported by vessel or air, record the four digit numeric Schedule D code which identifies the U.S. port at which the merchandise was unladen from the importing vessel or aircraft (NOTE: A list of the Schedule D port codes is included in the HTS as Annex A). Do not show the name of the port of unlading instead of the numeric code. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(27) Import Date: |

For merchandise arriving in the |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

ETA POE: |

Enter the estimated time of arrival at the place of entry in MM/DD/YY format. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Paperless 7501 Box: |

Check this box if you want to the entry to be paperless. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Cert Cargo Box: |

Check this box to certify the entry. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Live Box: |

Check this box if this is a live entry. Make sure your entry type corresponds with this option. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

HMF: |

Check this box on ocean shipments to confirm harbor maintenance fee. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

ACE: |

Check this box if it is an ACE entry. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Remote Box: |

Check this box if this is going to be a remote filed entry. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

D.E. : |

Enter the designated exam site for the cargo if it is different than port of arrival for remote entries otherwise leave blank. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Total Value: |

Enter the total value for the first invoice to help complete screen 2 faster. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Total Charges: |

Enter the total charges for the first invoice to help complete screen 2 faster |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Total Weight: |

Enter the total weight for the first invoice to help complete screen 2 faster. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Button Name |

Description |

|

Ok |

Click here to save and continue to screen 2. |

|

Cancel |

Exit without saving. |

|

Misc |

Click to view the Misc screen. |

|

Finished |

Click here to save and exit. |

|

Summary |

The miscellaneous screen keeps the extra fields that are not used very often. |

|

Field Name |

Description |

|

Surety |

The 3-digit code associated with the Surety company |

|

Commodity Team |

The 3-digit number associated with the commodity specialist at Customs |

|

Manifest |

Manifest number |

|

O.R. |

Enter the original warehouse reference number. Click the lookup button to add withdrawals. |

|

Final |

Check here if this is the final withdrawal |

|

TIB Exp. Date |

Enter the temporary importation bond expiration date. |

|

FTZ0002 |

Enter the foreign trade zone number. |

|

NAFTA |

Whether the shipment has to do with NAFTA |

|

Other |

The 3-digit code having to do with NAFTA |

|

Missing Docs 1 |

|

|

Missing Docs 2 |

Same as above. |

|

AD/CV |

If you are Deferring your ADD/CVD against your Bond. You must enter the Surety code in this field. |

|

HMF |

Harbor Maintenance Fee. Yes or No |

|

Warehouse # |

The original warehouse entry number |

|

G.O. # |

In the case of merchandise placed in general order, record the number assigned by Customs in the following format:

|

|

R/L |

1-Bill of Lading; 2-Pay; 3-Release |

|

Transmit |

Yes or No whether you transmit this information to |

|

Messenger |

Select code 1-5 |

|

Purchased |

Statement from 7501 left hand corner. Purchased or not purchased |

|

P/S/C |

Select from personal effects, samples, or consolidated |

| Electronic Indicator | For remote entries an E will be here. If you mistakenly make the entry remote, then take it off. You should verify this field is blank or aii errors may occur. |

|

Button Name |

Description |

|

Ok |

Click here to accept, save and exit. |

|

Cancel |

Exit without saving. |

|

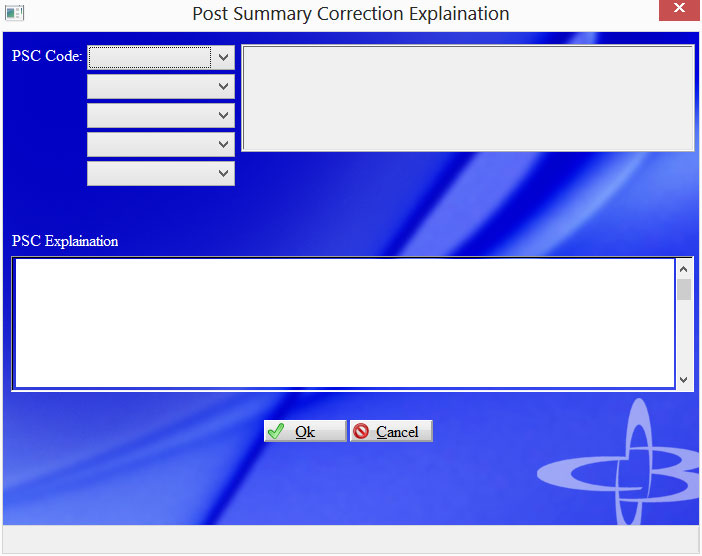

Post Summary Correction |

Click here to open the ACE Post summary correction screen. |

Post Summary Correction

|

Summary |

The post summary correction screen allows entry of post summary codes and explainations for ACE entries. |

|

Field Name |

Description |

|

PSC Code |

|

|

PSC Explaination |

|

Button Name |

Description |

|

Ok |

Click here to accept, save and exit. |

|

Cancel |

Exit without saving. |

|

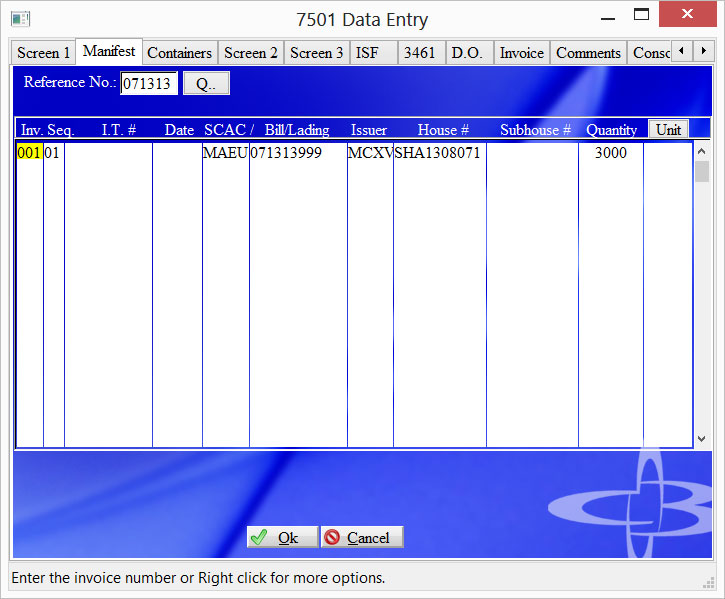

Summary |

|

|

Field Name |

Description |

|

Reference No. |

|

|

Inv. |

This will be the Invoice Sequence that this particular Manifest line will correspond. Right click for more options. |

|

Seq. |

If there is more than one Manifest line per Invoice, this is used to identify a second, third etc. line. |

|

I.T. # |

This is the Customs I.T. number, it will default from what had been entered on the first screen If different from the first screen it may be changed. |

|

Date |

A numeric date related to the in-bond number in MMDDYY (month, day, year) format. Multiple ITs may be combined on an entry summary only if all the IT dates are the same |

|

SCAC/ |

|

|

Bill/Lading |

|

|

Issuer code of HouseBill |

Scac of the party who issued the house bill of lading. |

|

House # |

A code representing the house bill number, If this is used on an Ocean Shipment the House Issuer is required. |

|

Subhouse # |

A code representing the sub-house bill number. |

|

Quantity |

|

|

Unit |

|

|

Button Name |

Description |

|

Ok |

Click here to accept save and exit. |

|

Cancel |

Exit without saving. |

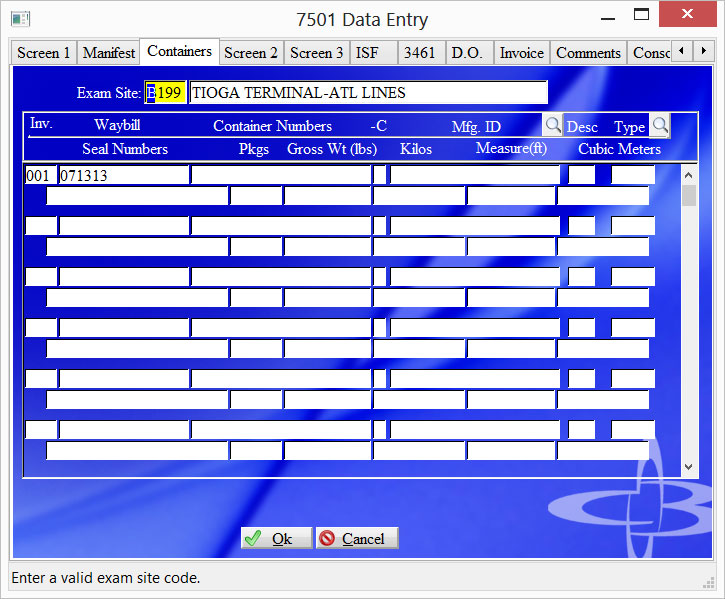

Containers

|

Summary |

|

|

Field Name |

Description |

|

Exam Site |

This is where the Designated Exam site of the cargo is to be entered. |

|

Inv. |

Your Invoice No. starting with 001. Right click for more options |

|

Waybill |

|

|

Container Numbers |

Enter the specific container number. -C Check digit is optional |

|

Mfg. ID |

|

|

Desc |

A description code for the container. Primarily used for ISF. Use the lookup. |

|

Type |

This is a special code identifying the container’s size (i.e. 40, 50 ). Use the lookup. |

|

Seal Numbers |

Enter any seal numbers on the container number in this field. |

|

Pkgs. |

|

|

Gross Wt (lbs) |

Gross weight of the specific container. |

|

Kilos |

|

|

Measure(ft) |

Length in Feet of the Container. |

|

Cubic Meters |

|

|

Button Name |

Description |

|

Ok |

Click here to accept save and exit. |

|

Cancel |

Exit without saving. |

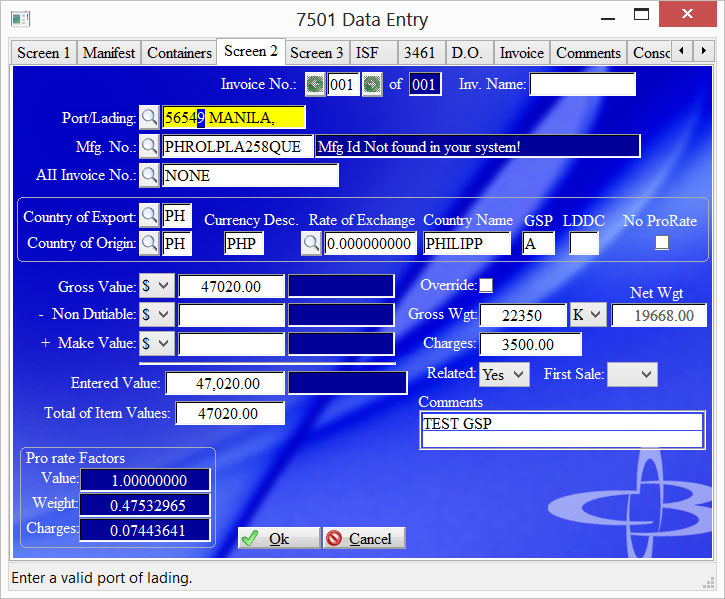

Screen 2

|

Summary |

|

Most of the fields on this screen will be automatically entered from the information you put into the first screen.

|

Field Name |

Description |

| Invoice No. |

The invoice number beginning with 001. If you entered the last invoice number on screen one you will see it in blue on the next field. When correcting an entry you can type in the invoice number you want to skip ahead to. Right click gives the options below. Import CSV Delete Invoice Recalculate reflects changes that you have made that necessitate recalculating the entry. For example, removing the invoice (Delete an Invoice). In order to have the correct totals for the entry, the entry must be recalculated. Copy previous Inv. Is self-explanatory. You want to copy the prior invoice because it is almost or is exactly the same with minor modifications. Copy AII Data/Seq brings the results of keying in the Automated Invoice Interface data into the entry. Please note that CBCC can create AII data as well as PQ data from spread sheet data that the user may create. |

| Inv. Name | Free format name of the invoice. Not sent to customs but will print on the 7501. |

| Port/Lading | Enter the port of lading code here. Should default from screen 1 |

| Mfg No. | Enter the Mfg id for this invoice. NOTE: Take special care when changing Mid that you correct it on all screens. |

|

AII Invoice Number |

If you are using Automated Invoicing (AII), you will enter the Invoice Number in this field if doing Invoice by Request. If you have already keyed the Automated Invoice it should appear automatically. If you are not using Automated Invoicing, this field will remain blank or NONE. If you enter something here it will try to create Aii. NOTE: You must delete the invoice to not send aii data. |

|

Country of Export |

This will default from the first screen’s entered data. |

|

Country of Origin |

This will also enter from the first screen’s entered data. If you have “CA” for Canada in this field, a box will appear asking you to select your Province code. PROVINCE/TERRITORY CODE XW- NEWFOUNDLAND (INCL. LABRADOR)

NOTE: When using EUR as the foreign currency right click and choose Use EUR to put in the desc and pull the rate for you. |

|

Currency Desc. |

This is a 3 letter abbreviation of the Country of Exports Currency system. |

|

Rate of Exchange |

This is the Rate of Exchange for the Country of Export based on the Export date. The system should pull the applicable rate. |

|

Country Name |

This is the name of the Country of Export. |

|

GSP |

A code representing the primary special programs indicator |

|

LDDC |

A code representing if the country is a Lesser Developed qualifying country. |

|

Gross Value |

The Gross value of this particular Invoice of the Entry. If entering in foreign currency make sure you choose 'O' and let the system convert it for you. |

|

Non Dutiable |

The non-dutiable value for this invoice. Normally subtracted from gross to give entered value. If entering in foreign currency make sure you choose 'O' and let the system convert it for you. |

|

Make Value |

This is the Add to Make Market Values for this entry. Normally added to gross to give entered value. If entering in foreign currency make sure you choose 'O' and let the system convert it for you. |

|

Entered Value |

This is a total of the Gross Value, Non Dutiable, and Make Value. |

|

Total of Items Value |

This is the total of all the 7501 tariff lines on this particular invoice. Whatever you have here is what needs to be keyed on screen 3. NOTE: If you are using 'O'ther currency MUST re-enter that amount here. |

| No Pro Rate | Check here to stop the computer from Pro rating the wgt and charges based on the invoice amount. |

| Override | Check here to over ride the computer and enter your own Gross Weight |

|

Gross Weight |

Record the gross shipping weight in kilograms for articles imported by ALL modes of transportation. This will show as the Total Weight from Screen 1. |

|

Charges |

|

|

Related |

Select Yes or No for Related. *Note: You can set a default value in the customer master for this field. |

|

Comments |

In this field you may enter special instruction that will be printed in the body of your 7501. |

|

Pro rate Factors |

|

|

Value |

|

|

Weight |

Record the gross shipping weight in kilograms for articles imported by ALL modes of transportation. This will show as the Total Weight from Screen 1. |

|

Charges |

The total charges for this particular invoice. |

|

Button Name |

Description |

|

Ok |

Click here to save and continue. |

|

Cancel |

Exit without saving. |

|

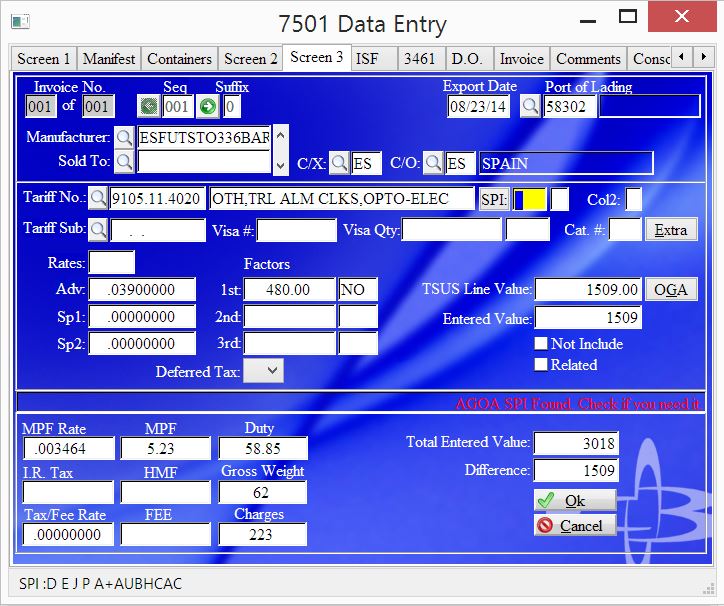

Summary |

This screen is used for identifying the commodity being transmitted on this particular invoice. All the Harmonized numbers, values, duties and additional fees will be assessed on this screen. Enter your tariff, factors and values until you have used up all of the value for this invoice. Clicking Ok after each line and increasing the sequence. When the difference is zero you are done and can say "Yes" to end of invoice. If there are no more invoices say "Yes" to End of Entry. Properly finishing out an entry is a very important step. DO NOT cancel out of this screen when making changes. Tabbing past the line value will allow proper recalculations and should not be skipped. |

NOTE: For remote entries you need to click Extra to enter your invoice lines.

|

Field Name |

Description |

|

Reference No. |

Y |

|

Invoice No. |

|

|

Seq. |

Record the appropriate line number, in sequence, beginning with the number 001. Right click for more options. |

|

Suffix |

|

|

Date |

This will display the Date of Export from the first screen. |

|

|

|

|

Manufacturer No. |

|

|

Sold To |

At the article/line level, the U.S. party or other

entity (individual or firm) to whom the

imported merchandise was sold or agreed to be sold.

If the merchandise is imported otherwise than in pursuance of

a purchase, the name of the owner of the merchandise must be

provided.

|

|

Deliver To |

The U.S. party or other entity (individual

or firm) identified as the first delivered-to party scheduled to

physically receive the merchandise after its release from CBP

custody.

-

As an IRS Number

with NO suffix: NN-NNNNNNNbb

(Where N is numeric and b is a space).

-

As an IRS Number

with a suffix: NN-NNNNNNNss

(Where N is numeric and s is A-Z, 0-9 [neither of the positions

of the suffix can be space]).

-

As a CBP assigned

identifier: YYDDPP-NNNNN

(Where YY is calendar year when the number was assigned, DDPP is

the district/port where the number was assigned, and N is

numeric). |

|

Foreign Party |

At the article/line level, the party or other

entity (individual or firm) identified as the last named foreign

party identified on the transaction invoice/purchase order that has

a substantial financial interest in the goods and who causes the

goods to be shipped by any mode of transport. This is not the

transportation shipping party (freight forwarder, consolidator, or

NVOCC). For consigned shipments, household effects, lease

transactions, and similar contractual arrangements, the name of the

supplier may be provided. The supplier could be a trading

company, selling agent, owner (e.g., personal/household effects), or

similar party.

For AD/CVD entry types:

OR

For shipments from a third country to the

United States customs territory:

The party or other entity (individual or

firm) in a country other than the country of manufacture or

production (19 C.F.R. 102) that has a substantial financial interest

in the merchandise beyond that of an entity who has custody under a

bill of lading and that directly ships the merchandise that is

subject to a countervailing or antidumping duty order under 19

U.S.C. 1671 or 1673 from that country other than the country of

manufacture or production (19 C.F.R. 102) under a contract for sale

to an entity in the United States.

When present, the Foreign Exporter Code

should be formatted in a manner consistent with the algorithm

described in CBP Directive 3500-13 (November 1986).

-

The ID must be at least

eight characters in length, must consist of uppercase characters A-Z

and numerals 0-9, and must not contain any embedded spaces.

-

The first two

characters must be a known ISO Country Code (or a Canadian Province

code found in AE Table 5 Canadian Province Codes). |

|

C/X |

|

|

C/O |

The country of origin |

|

Tariff No. |

Record the appropriate HTS 10-digit numbers. You are responsible for keeping your tariff database up to date. See Tariff queries for more information.

|

|

Tariff Description |

A description of the articles in sufficient detail to permit the classification thereof under the proper statistical reporting number in the HTS should be reported across the top of block 30 to 32. The standard definitions from HTS tape extracts from the Customs HTS data base are acceptable for this requirement. |

|

SPI |

Valid Special Program Indicator Codes are: Code Description A GSP applies to the tariff number. |

|

Col2 |

|

|

Tariff Sub. |

|

|

Visa # |

|

|

Visa Qty |

The amount of goods being imported. This amount is always a whole number and cannot exceed the amount indicated on the visa |

|

Cat. # |

A number representing the textile or textile product category. This can be found on the Tariff number. |

|

Rates |

This is the Rate being pulled form the Harmonized Tariff system. |

|

Adv. |

This is the Ad-Valorem Rate being pulled from the tariff master. |

|

Sp1 |

This is the Spec 1 Rate for this tariff classification. |

|

Sp2 |

|

|

Factors 1st |

|

|

2nd |

Same as above, a second statistical factor if necessary. |

|

IRT |

This is I.R. Tax as may be required by US Customs. It is usually pulled from the Tariff Classification. There are instances on Tobacco and Alcohol that manual I.R. Tax may need to be calculated. |

|

Deferred Tax |

1 = deferred tax 2 = deferred tax paid by electronic fund transfer (EFT) 0 = no deferred tax Arrangements must be made with the National Finance Center (NFC) before using the deferred tax indicator for electronic fund transfer. |

|

TSUS Line Value |

This is the value of this particular commodity line of the invoice. Right click for more options. The manual duty option can be used to override duties with the amount you enter in the Adv rate field. |

|

Entered Value |

This is the rounded value in whole dollars of your Tsusa Line value. It also will be a converted foreign currency amount. |

|

Not Included |

|

|

Related |

|

|

MPF Rate |

This is the MPF Rate, currently set at .003464 |

|

MPF |

|

|

Duty |

This is the Duty total amount for this tariff line. Calculated by special tariff codes and value |

|

I.R. Tax |

If there is IR tax on the shipment, the total for this line will appear. |

|

HMF |

|

|

Gross Weight |

|

|

Tax/Fee Rate |

|

|

FEE |

E. OTHER FEES |

|

Charges |

In accordance with HTS General Statistical Note 1 (a)(XIV), record the aggregate cost (not including U.S. import duty, if any) in U.S. dollars of freight, insurance and all other costs, charges and expenses incurred in bringing the merchandise from alongside the carrier at the foreign port of exportation in the country of exportation and placing it alongside the carrier at the first U.S. Port of entry. Effective July 1, 1989, record charges for shipments arriving in the |

|

Totaled Entered Value |

|

|

Difference |

|

|

|

|

|

Button Name |

Description |

|

Extra |

|

|

OGA |

Valid Other Government Agency (OGA) codes are: Code Description AP2 Animal and Plant Health Inspection Service (APHIS) inspection required. The Bolded are the agencies used by CBP that must be sent or disclaimed. The ones in Italics are REQUIRED… |

|

Ok |

Click here to save and continue. |

|

Cancel |

Exit without saving. |

|

Summary |

|

|

Field Name |

Description |

|

Pirp No. |

|

|

Ruling Type |

R = Binding Rulings C = Preclassification P = Pre-approval D = Commercial Description This code is required for paperless processing. When using “INVREQ” the Binding Ruling’s Code “R” is required. |

|

Comm. Desc. |

The invoice line description of the commodity. Broad, generalized language is unacceptable, as are tariff descriptions. Complete commercial terminology, in the English language, is mandatory. |

|

AII From |

|

|

AII TO |

A number from 0002 to 9999 representing the last number in a range of invoice line numbers associated with the entry summary line. For single lines leave this field blank. NOTE: spacing out the From/To field DOES NOT DELETE IT. Use the red X button to remove aii line items. |

| Sold To Party | Enter the sold to parties IRS number for ACE shipments. NOTE: Enter the five character customer number and we will input the irs number for you. |

| Foreign Exporter | Enter the foreign exporter id code. Only for special ACE shipment types. |

|

Cotton Exempt |

|

|

IRT No. |

|

|

PER pfl |

|

|

FTZ Status |

P = Privileged Foreign Merchandise D = Domestic Merchandise N = Non-privileged Foreign Status Z = Zone Restricted Merchandise This code is mandatory if the entry type code is 06 (Foreign Trade Zone). |

|

Priviledged Status Date |

|

| NAFTA Net Cost Ind | Select Y or N |

| License/Cert/Permit/ Code | Choose a license/Certificate or Permit from the drop down and enter it's number. |

|

|

N-AA-NNN-N N-AB-NNN-N where N = numeric, A = alphabetic, and B = space fill. Steel License Wool License This is a Miscellaneous license field. You would enter a TPL number if you have one in this field. For Softwood Lumber- For softwood Lumber- A 9 numeric Canadian Softwood Lumber Permit number (right justified) that is furnished by the country of origin if “first manufactured” in XO, XQ, XC or XA. |

| Census Code/Override | Select the correct census code and matching override code for ace entries |

| PSC | Select a post summary correction code for the line level. Only for Ace entries |

|

Button Name |

Description |

|

Ok |

Click here to save and exit. |

|

Cancel |

Exit without saving. |

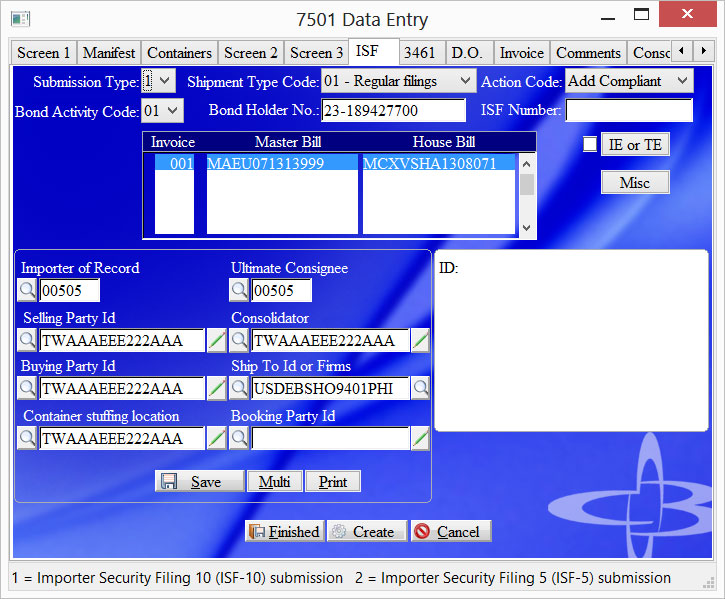

ISF

|

Summary |

|

|

Field Name |

Description |

|

SF Submission type |

1 = Importer Security Filing 10 (ISF-10) submission |

|

Shipment Type code |

Only used for SF Submission Type 1 01 = Standard or regular filings 02 = To Order Shipments 03 = HHG/PE |

|

Action Code |

|

| Bond Activity Code | Select the bond activity code. 01 is normal 16 is special ISF bond requiring bond number put in on Misc screen. |

| Bond Holder No | Importer of Records IRS number. Tab past Imp Rec field to import from master. |

| ISF Number | ISF Number returned from customs or gotten from other filer of ISF |

| Inv/Master/House Bill |

Information from Manifest tab. ISF is based on these numbers so make sure they are correct. Right click for many options. |

|

Importer of Record |

Importer of Record |

|

Ult Consignee |

|

| Selling Party Id | Enter selling party id. If you enter a few letters and tab it will return a top ten list for you to choose from. Confirm the address in the display window to the right. Right click allows for copying of other parties. |

| Buying Party Id | Enter buying party id. If you enter a few letters and tab it will return a top ten list for you to choose from. Confirm the address in the display window to the right. Right click allows for copying of other parties. |

| Ship To Id | Enter ship to party id. If you enter a few letters and tab it will return a top ten list for you to choose from. Confirm the address in the display window to the right. Right click allows for copying of other parties. |

| Container Stuffing Location | Enter container stuffing location id. If you enter a few letters and tab it will return a top ten list for you to choose from. Confirm the address in the display window to the right. Right click allows for copying of other parties. |

| Consolidator | Enter consolidator party id. If you enter a few letters and tab it will return a top ten list for you to choose from. Confirm the address in the display window to the right. Right click allows for copying of other parties. |

| Booking Party | Enter booking party id. If you enter a few letters and tab it will return a top ten list for you to choose from. Confirm the address in the display window to the right. This field is ONLY used on isf 5. Right click allows for copying of other parties. |

| Misc | |

| Term Bond No. | |

| Term Bond Indicator | |

| Code Qualifier 1 | |

| Code Qualifier 2 | |

| IE or TE | |

| Place of Delivery | Enter place of delivery |

| Foreign Port Unlading | Enter foreign port code |

|

Button Name |

Description |

|

Ok |

Save and continue |

|

Create |

Create this ISF for CBP |

|

Cancel |

Exit without saving. |

ISF Misc

|

Field Name |

Description |

| Submit Entry No with ISF | Choose Yes to send entry number with ISF |

| Submit Master Bill | Choose Yes to send Master bill number with ISF |

| Carnet | Carnet number. Can be repeated 10 times |

| User Ref | User ref. Can be repeated 10 times |

| Surety Code | Surety code |

| Bond Ref No | Bond number from Surtey company |

| Full Name of ISF Importer | Full name of importer used with informals and by bond type 16 |

| Informal Shipment Details | |

| Shipment Sub Type | Informal entries require additional information. Choose submission type |

| Est Value | Enter estimated value |

| Est Qty | Enter estimated quantity |

| UOM | Enter Unit of Measure |

| Est Wgt K/L | Enter estimated weight and Kilos or Pounds |

|

Button Name |

Description |

|

Ok |

Save and continue |

|

Cancel |

Exit without saving. |

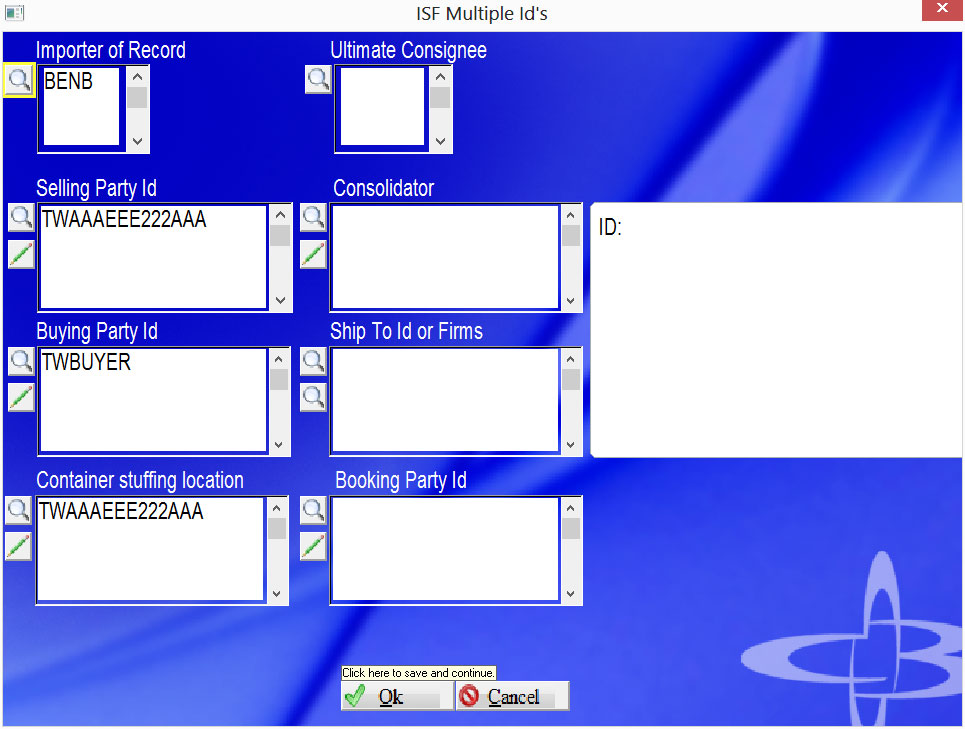

ISF Multiples

When multiple parties are involved enter them in their appropriate fields. Lookup and edit fields act the same as the first screen. Click Ok to save or Cancel to exit without saving.

|

Button Name |

Description |

|

Ok |

Save and continue |

|

Cancel |

Exit without saving. |

|

Summary |

The Cargo Release/Selectivity Information can be entered here. All information pertaining to the 3461 is entered under this screen. If you have previously Certified the entry via the 7501, this screen will appear completed. |

Note: For more details on the 3461 fields please see the 3461 Data Entry help manual pages

|

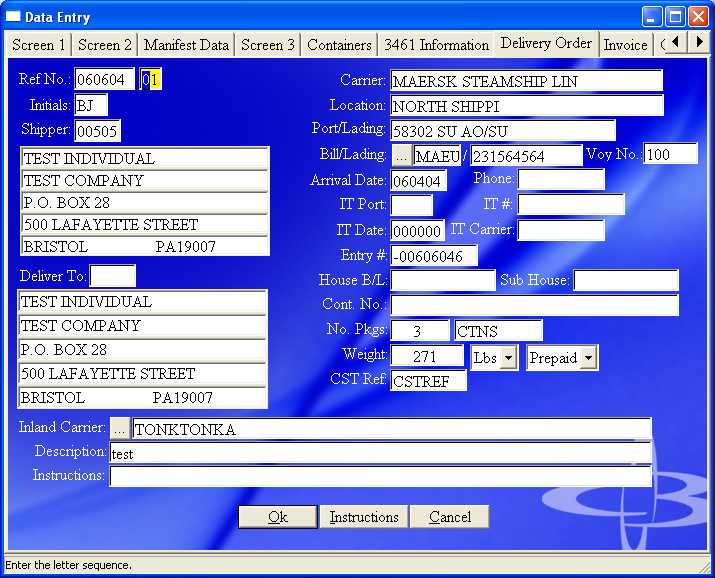

Summary |

This is for creating a delivery order for the Trucker or Importer. Most of this information should appear based on the entry previously being keyed. |

Note: For more details on the delivery order please see the Deliver Order Data Entry help manual pages

Invoicing Screen

|

Summary |

This is for creating an invoice for this shipment. Most of this information should appear based on the entry previously being keyed. |

Note: For more details on the invoice fields please see the accounting Invoice Data Entry help manual pages

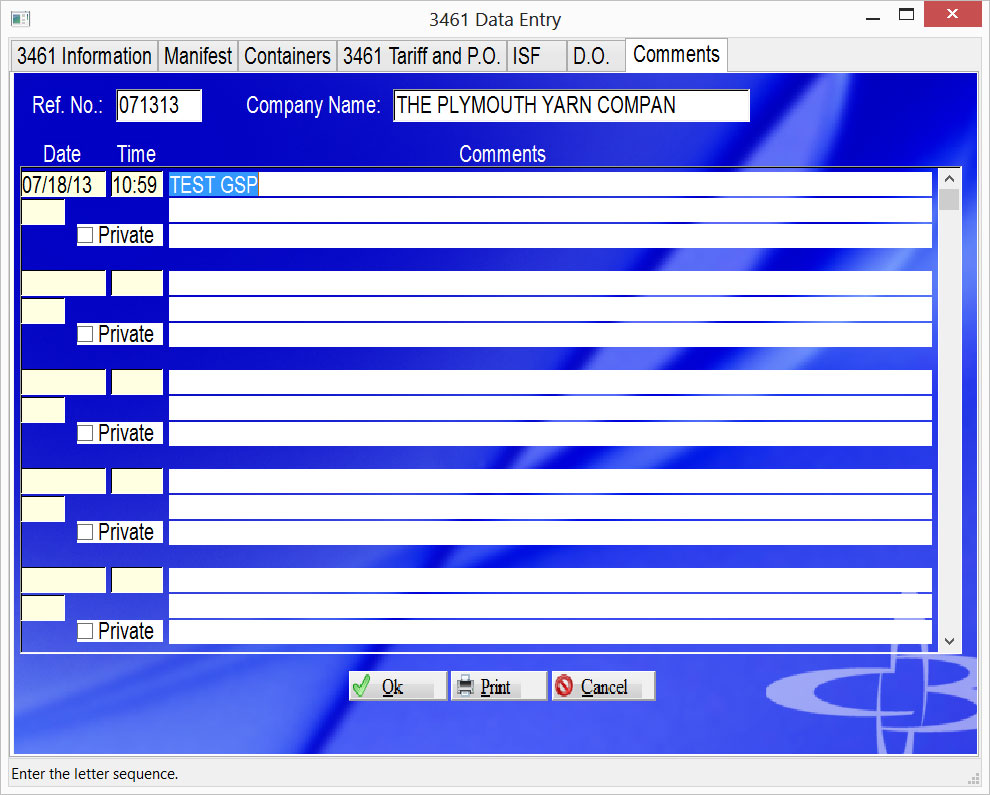

Comments

|

Summary |

This screen is for entering comments for this file, not the customer. The date and time will be entered after you key up to three lines of comments. Check Private if you do not want the comment to be uploaded to Webtracker. |

|

Field Name |

Description |

|

Comment |

|

|

Private |

Check here if you do not want the comment uploaded to webtracker. |

|

Button Name |

Description |

|

Ok |

Click here to accept save and exit. |

|

|

Click here to print these comments |

|

Cancel |

Exit without saving. |

|

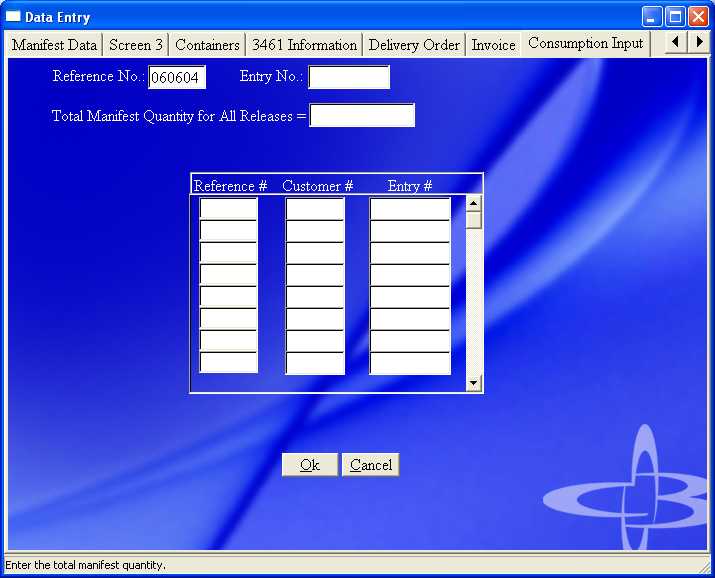

Summary |

|

|

Field Name |

Description |

|

Reference No. |

|

|

Entry No. |

This number is created from your reference number as a base and calculates the correct check digit. You may also enter your own number. Detailed instructions concerning the entry number are contained in Customs Directive 3500-08, dated June 19, 1986, (Customs), and Customs Directive 3500-058, dated September 10, 1991. An entry number, in this format, is required on all broker/importer prepared informal (which require a CF 7501) and warehouse entries |

|

Total Manifest Quantity for All Releases= |

This is the Total quantity of all the entry numbers entered in the consolidated entry field. |

|

Reference # |

The reference number of the file you are attempting to consolidate |

|

Customer # |

The customer number that is assigned to the reference number you are using. |

|

Entry # |

The entry number that is assigned to the reference number you are using |

|

Button Name |

Description |

|

Ok |

Click here to accept save and exit. |

|

Cancel |

Exit without saving. |

Copyright © 2015 E.D. Bustard Inc.