Click on the screen you wish to view, or scroll down to view all:

| Delivery Order | Comments |

|

Summary |

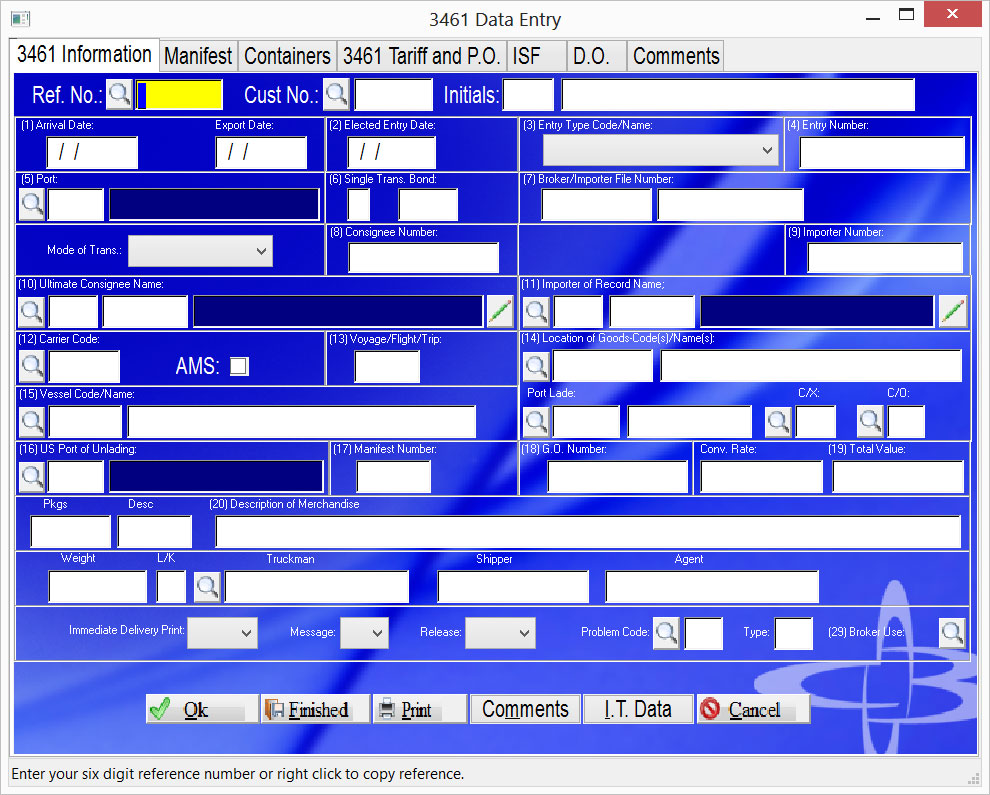

The 3461 data entry program. It is recommended to key the 7501 first and Certify cargo so that you do not need to key this program. However filing ISF's is easier from here along with using a template. |

|

Video |

Click here for a video of this program. |

To Key a 3461:

- Click Import, 3461 Referencing, (5) 3461 Data Entry

- Enter the mandatory reference, customer and intials

- Input all other known data and click Ok to save and continue to the next tab.

- Input information on the other tabs until complete.

- Cancel to exit. Click Finished if you have created ISF instead of Cancel

|

Field Name |

Description |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Ref. No.

|

Enter your reference number or click the look up button. This field has a right click option that allows for Inquiry, Computer Assign Ref, Clear screen, Delete, Print and Change customer number. This field is mandatory. Right Clicking this filed will allow the option of: Copy Refernce-You can copy a previously keyed 3461 and change info for this new file. Computer Assing Ref-If the feature is set up in CBCC, it will use the next available Ref Number Delete 3461-You have the option to Delete the 3461 out of the Print File Clear-This clears the present info on the screen to add another reference. Change Customer No. - Change the customer number Template - Pull a template for faster data entry |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Cust No. |

Enter a valid customer number or click the look up button to select one. This is part of the key to a reference and care should be taken to choose the correct number. To change this, right click on reference and choose change customer no. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Initials |

Enter

your initials. This field has become mandatory for creation of entries and

other functions. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Arrival Date |

The arrival date |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Export Date |

The export date especially for ISF's. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Elected Entry Date |

Record the six digit numeric code: month, day, and year (MMDDYY). Normally, it is the date the goods are released except for immediate delivery, quota goods, or where importer/broker requests another date prior to release (see 19 CFR 141.68). It is the responsibility of the filer to ensure that the entry date shown for entry/entry summaries is the date of presentation (i.e., the time stamp date). |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Entry type |

Record the appropriate entry type code by selecting the two digit code for

the type of entry summary being filed. The first digit of the code identifies

the general category of the entry (i.e., consumption =0, informal =1,

warehouse =2, etc.). The second digit further defines the specific processing

type within the entry category. Therefore, a consumption quota entry should

be recorded under code 02, an informal free or dutiable entry under code 11,

etc.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Entry Number |

Will be filled in by the computer using the reference number and filer code as a base for calculating the check digit. This number is created from your reference number as a base and calculates the correct check digit. You may also enter your own number. Detailed instructions concerning the entry number are contained in Customs Directive 3500-08, dated June 19, 1986, (Customs), and Customs Directive 3500-058, dated September 10, 1991. An entry number, in this format, is required on all broker/importer prepared informal (which require a CF 7501) and warehouse entries. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Port |

Enter the four digit numeric code of the |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Single Trans Bond |

This

is the customers bond type and should not be changed. Record the single

digit numeric code as follows: |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Broker File Number |

Enter

the broker's file number or importer's reference number. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mode of Trans |

Mode of transportation (10 Vessel, 20 Rail, 40 Air, etc) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Consignee No. |

Record the IRS, Social Security, or Customs assigned

number of the consignee. This number must reflect a valid identification

number filed with Customs via the CF 5106 or its electronic (ACS) equivalent.

When the consignee number is the same as the importer of record number, the

word "SAME" may be used in lieu of repeating the importer of record

number. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Importer No. |

Enter a valid account and customer number for the Importer of Record. The importer of record is the individual or firm liable for payment of all duties and meeting all statutory and regulatory requirements incurred as a result of importation. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Ultimate Consignee |

The account number and code of the Ultimate Consignee you have identified with a specific customer number and IRS number. The button with the pencil lets you view and manually edit the address. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Import of Record |

The account number and code of the Importer of Record you have identified with a specific customer number and IRS number. The button with the pencil lets you view and manually edit the address. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Carrier Code |

For merchandise arriving in the FTZ NNNN |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

AMS |

Check this Box if the Carrier is a Valid carrier in the Automated Manifest System (can also be defaulted by adding AMS check in the SCAC code Master Files) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Voyage/Flight No. |

Valid Import Voyage or Flight number assigned to the Shipment, Enter the voyage number with out the V- the system will add that upon printout. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Location of Goods |

Where the entry summary serves as entry/entry

summary record the pier or site where the goods are available for

examination. For air shipments, record the flight number. Where FIRMS codes

are available, they may be used in lieu of pier/site. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Vessel Code/Name |

Type the name of the Vessel in this field. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Port lade |

For

merchandise arriving in the U.S. by vessel, record the five digit numeric

code listed in the Department of Commerce Schedule K for the foreign port at

which the merchandise was actually laden on the vessel that carried the

merchandise to the U.S. (NOTE: A January 1, 1991 edition of the Schedule K

listing is included in this issuance as Appendix E). If the foreign port of

lading is not provided for by name in the Schedule K, use the code for

"all other ports" for the port of foreign lading for the country. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

C/X |

Enter the exporting country utilizing the two character alpha ISO country

codes specified in the International Standard ISO 3166 (a list of the ISO two

character alpha codes is provided as Appendix C in this issuance). If you are using |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

C/O |

Enter

the country of origin utilizing the ISO country codes specified in

International Standard ISO 3166 (listed as Appendix C in this issuance). If

you are using |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

For merchandise imported by vessel or air, record

the four digit numeric Schedule D code which identifies the U.S. port at

which the merchandise was unladen from the importing vessel or aircraft

(NOTE: A list of the Schedule D port codes is included in the HTS as Annex

A). Do not show the name of the port of unlading instead of the numeric code. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Manifest Number |

The Manifest number |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

G.O. Number |

In the case of merchandise placed in general order, record the number

assigned by Customs in the following format: G.O. NNNNNNNNNNNN |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Conv Rate |

This is the Rate of Exchange for the Country of Export based on the Export date. The system should pull the applicable rate |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Total Value |

This is the total of all the 3461 tariff lines on this particular invoice. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Pkgs Desc |

An abbreviation representing the unit of measure as indicated on the B/L or AWB. A standard generic unit of PCS (pieces) is acceptable when there are multiple units of measure associated with the bill of lading or air waybill; however, this does not relate to the unit of measure required for a specific tariff number. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Description |

Brief description of the Commodities contained on this 3461 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Wgt L/K |

Record the gross shipping weight in kilograms for articles imported by ALL modes of transportation |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Truckman |

Name of the Trucking Company moving the goods. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Shipper |

Shipper short name |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Agent |

Vessel agents name |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Immediate Delivery |

If an 3461 is not currently in your CBCC 3461 Print File, placing a “Y” in this field will restore it back in. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Message |

This field can be used to leave a specific message for this particular entry and customer. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Release |

You can show the Status of the entry in this Field as “B/L” for update, “REL” for Released, or “PAY” as it is already paid on a statement. This is an interoffice code and doesn’t get updated by CBP or transmitted. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Problem Code |

This field allows you to enter inter office codes for your reference in regards to problems that may have arisen during transmission. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Type |

Special type code |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Broker Use |

This button opens a screen to allow four lines of special broker use information that will print in box 29 of the 3461. Not normally used. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Button Name |

Description |

|

Ok |

Save and continue |

|

Finished |

Click to save and exit |

|

|

Print this 3461 now. |

|

Comments |

Enter comments for this reference. |

|

I.T. Data |

Open the I.T. program |

|

Cancel |

Exit. |

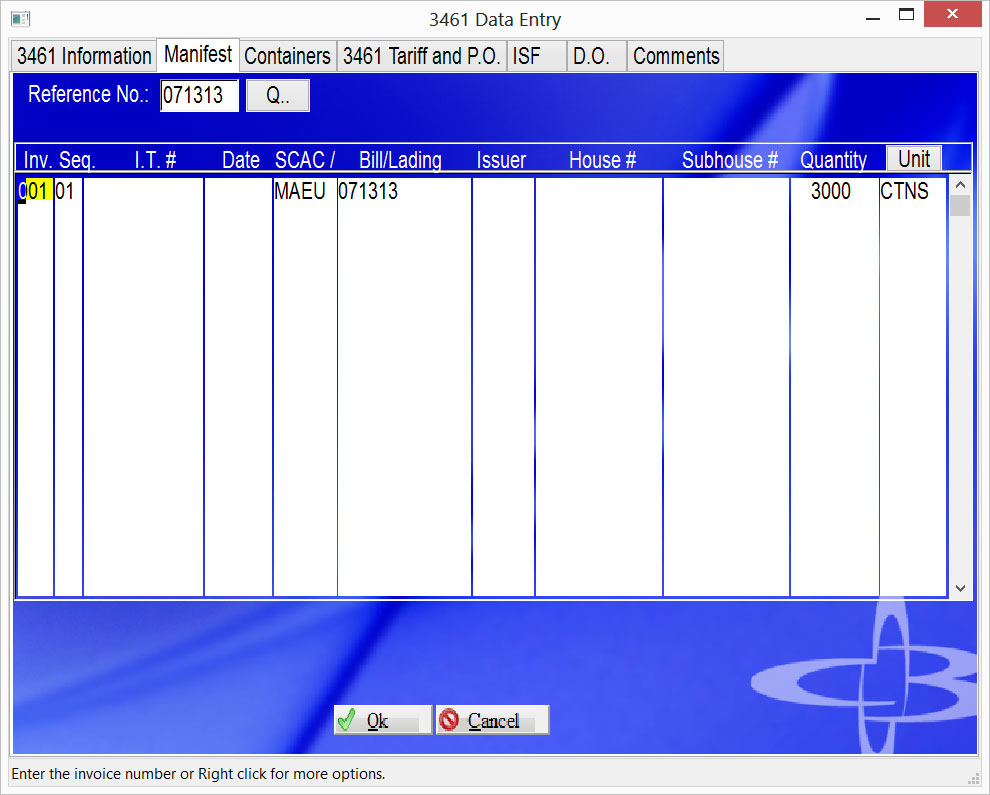

The manifest tab is shared with multiple programs and works the same in each.

|

Field Name |

Description |

|

Inv. |

This is the Invoice Sequence that this particular BL/AWB is contained on. The First Invoice would be Sequence 001, Second Invoice is 002, ETC. The right click will allow you to copy and delete |

|

Seq |

If there were multiple BL/AWB’s on a particular

Invoice. The First AWB/BL on Invoice it would appear as INV 001 and

have SEQ 01, if there where a second

BL/AWB that would be Invoice INV 001 SEQ 02. If there were more on Invoice Two it would

appear as INV 002 SEQ 01 and begin

counting sequentially up from 01 again. |

|

I.T # |

This is the Customs I.T. number, it will default from what had been entered on the first screen If different from the first screen it may be changed. Right click has option to open the query program |

|

Date |

A numeric date related to the in‑bond number in MMDDYY (month, day, year) format. Multiple ITs may be combined on an entry summary only if all the IT dates are the same |

|

SCAC |

A code representing the

Standard Carrier Alpha Code (SCAC) of the party who actually issued the ocean

bill of lading. Do not confuse the

issuer of the bill with the operator of the vessel. |

|

Bill Lading |

A code representing the master bill number This code is required if the mode of transportation code is 10 (vessel, non‑container), 11 (vessel, container), 20 (rail, non-container), 21 (rail, container), 40 (air, non-container), or 41 (air, container); otherwise, space fill. After you enter the number we read our database to check if the number has already been use. We also check the ISF status and display in red at the bottom. Right click has the ability to create a query based on the number entered. If you send/receive automatically it is possible to have the results of that bill before you finish keying.

|

|

Issuer |

SCAC

OF THE PARTY WHO ISSUED THE AUTOMATED OCEAN/RAIL HOUSE BILL OF LADING.

THIS PARTY MAY BE EITHER AN AUTOMATED NVOCC OR THE AUTOMATED ISSUER OF THE

MASTER BILL. WHEN THE ISSUER CODE OF HOUSE BILL NBR IS TRANSMITTED FOR MOT

10, 11, 20, 21, THE HOUSE BILL OF LADING WILL ALSO BE REQUIRED. FOR ENTRY |

|

House # |

A code representing the

house bill number, If this is used on an Ocean Shipment the House Issuer is

required. Right click has option to open the query program |

|

Subhouse # |

A code representing the sub‑house bill number |

|

Quantity |

A value representing the quantity associated with the Immediate Transportation (IT), bill of lading (B/L), Automated Manifest System (AMS) master in‑bond number, or the air waybill (AWB) number. The most detailed level of the shipment is reported (i.e., the smallest exterior packaging unit). |

|

Units |

An abbreviation representing the unit of measure as indicated on the B/L or AWB. A standard generic unit of PCS (pieces) is acceptable when there are multiple units of measure associated with the bill of lading or air waybill; however, this does not relate to the unit of measure required for a specific tariff number. |

|

Button Name |

Description |

|

Unit |

Click here to open container code lookup |

|

Ok |

Save and continue |

|

Cancel |

Exit. |

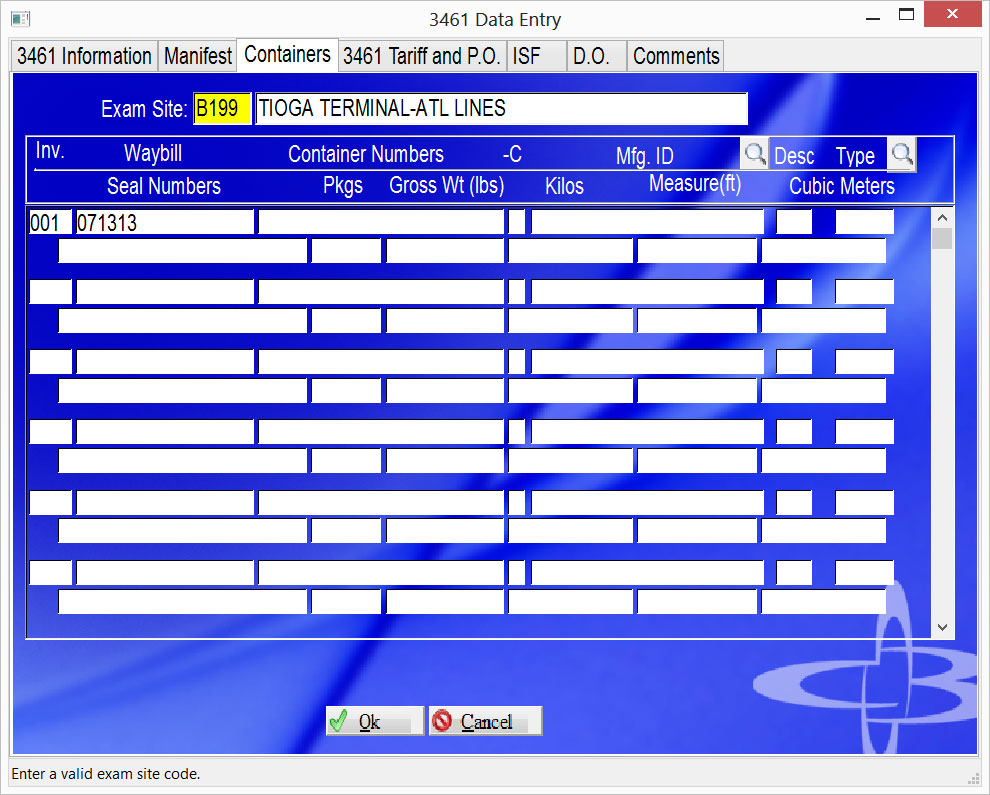

The container tab is shared with multiple programs and works the same in each. At this time it is recommended to skip container tab when doing ISF unless all information is known.

|

Field Name |

Description |

|

Exam Site |

This

is where the Designated Exam site of the cargo is to be entered. |

|

Inv |

Invoice no usually beginning with 001. Right click allows for insert,copy,delete or importing data. |

|

Waybill |

The bill number. Right click brings up standard windows options |

|

Container No. |

Enter this Specific container number from your documentation. - C is for the container check digit. |

|

MFG ID |

A code identifying the manufacturer/supplier. The first two positions of the code for Canadian manufacturers/shippers is a CBP assigned code for the Canadian province/territory instead of the International Organization for Standardization (ISO) country code. Refer to CBP Directive 3500‑13, dated November 24, 1986, for complete instructions on determining the manufacturer/supplier code |

|

Size / Type |

This

is a numeric code identifying the container’s size (i.e. 40, 50 ) |

|

Seal Number |

Enter any seal numbers on the container number in this field. |

|

Pkgs |

A value representing the quantity associated with the Container |

|

Gross Wt |

Gross weight of the specific container |

|

Kilos |

Weight in Kilograms of the container. |

|

Measure |

Length in Feet of the Container |

|

Cubic Meters |

Dimensions in Cubic meters of the container |

|

Button Name |

Description |

|

Inquiry |

The Desc magnifying glass icon brings up the equipment lookup. The Type lookup helps you create the 5 character code necessary for ISF filings. |

|

Ok |

Save and continue |

|

Cancel |

Exit. |

|

Field Name |

Description |

|

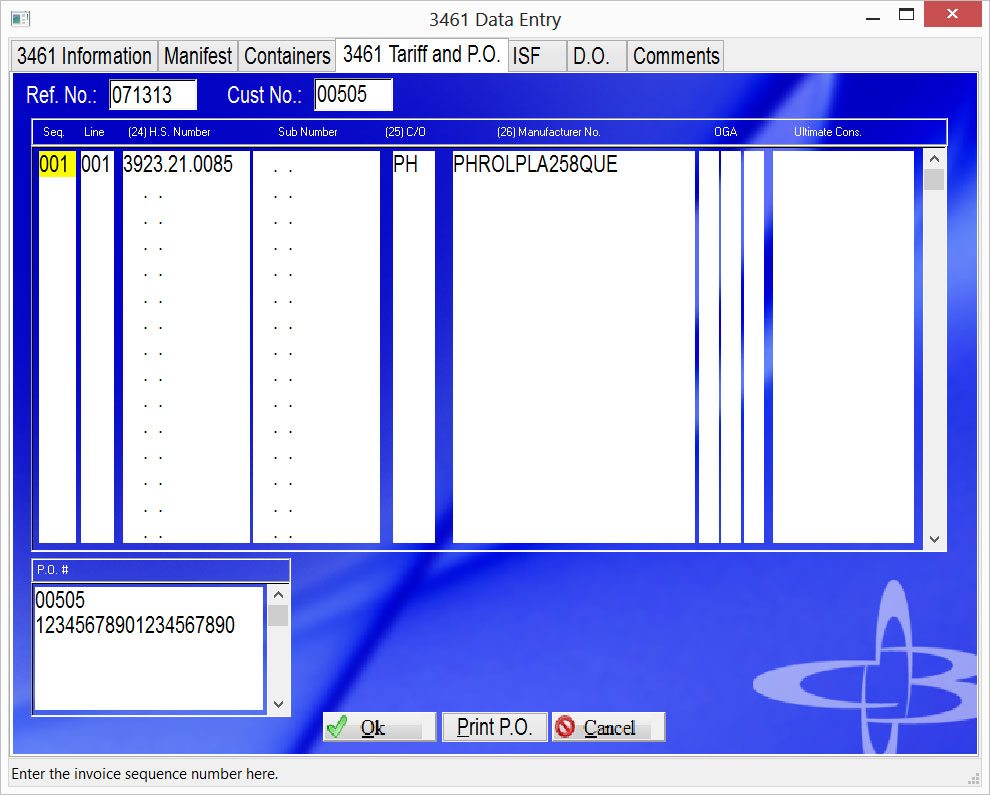

Seq. |

Record the appropriate line number, in sequence, beginning

with the number 001. |

|

Line |

If using a 98, 99, Watch, Ensemble or tools more than 2 in a set |

|

H.S. Number |

Record the appropriate HTS 10-digit duty/statistical reporting number along with the check digit if one is used (check digits are required on all 10-digit numbers; 8-digit numbers, such as those in Chapter 99 of the HTS, do not require check digits). This number should be left justified. Decimals are to be used in the 10- digit duty/statistical reporting number exactly as they appear in the HTS. The check digit is not to be separated by a dash or decimal. An example of the correct presentation of the duty/statistical reporting number would be as follows: |

|

C/O |

The Country of Origin |

|

Manufacturer No. |

A code identifying the manufacturer/supplier. The first two positions of the code for Canadian manufacturers/shippers is a CBP assigned code for the Canadian province/territory instead of the International Organization for Standardization (ISO) country code. Right Clicking here will: Look Up ID- Search your MID Files for existing MIDs you have on file Query ID thru ABI-Will Transmit and MID query with your entry to ensure it is on file with CBP Update Entry with ID-This will update the Entry with the MID you have selected. Add to Master-This will add this MID to your CBCC MID File. |

|

OGA |

N=Disclaim the Other Government Agency D=Send Food and Drug C=Send FCC Valid Other Government Agency (OGA) codes are: Code Description AP2

Animal and

Plant Health Inspection Service (APHIS) inspection required. |

|

Ultimate Cons. |

If you are doing a consolidated shipment, you may put the Consignee IRS number in this field next to the Classification that is owned by that consignee. If doing a consolidated shipment with multiple consignees the 3461 must be done first |

|

P.O. # |

A purchase Order number can be entered here. |

|

Button Name |

Description |

|

Ok |

Save and continue |

|

Print P.Q |

Print the P.Q. table list |

|

Cancel |

Exit without saving. |

|

Summary |

|

|

Field Name |

Description |

|

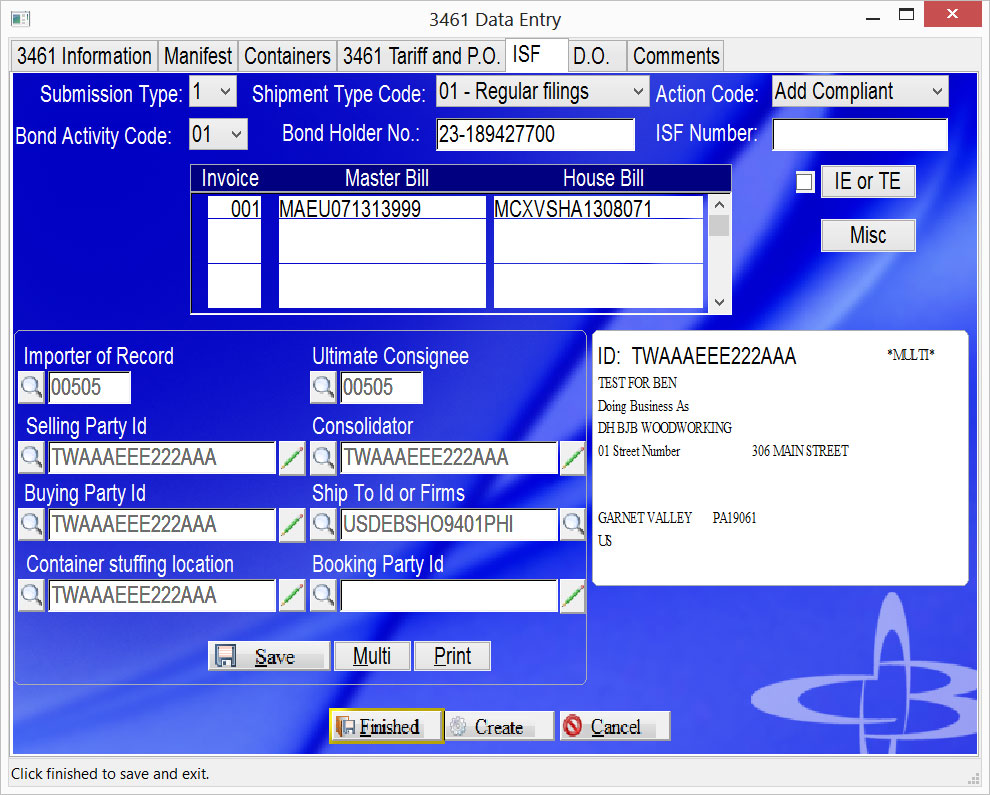

SF Submission type |

1 = Importer Security Filing 10 (ISF-10) submission |

|

Shipment Type code |

Only used for SF

Submission Type 1 01 = Standard or regular

filings 02 = To Order Shipments 03 = HHG/PE |

|

Action Code |

|

| Bond Activity Code | Select the bond activity code. 01 is normal 16 is special ISF bond requiring bond number put in on Misc screen. |

| Bond Holder No | Importer of Records IRS number. Tab past Imp Rec field to import from master. |

| ISF Number | ISF Number returned from customs or gotten from other filer of ISF |

|

Inv/Master/House Bill |

Information from Manifest tab. ISF is based on these numbers so make sure they are correct. Right click for many options. |

|

Importer of Record |

Importer

of Record

|

|

Ult Consignee |

|

| Selling Party Id | Enter selling party id. If you enter a few letters and tab it will return a top ten list for you to choose from. Confirm the address in the display window to the right. Right click allows for copying of other parties. |

| Buying Party Id | Enter buying party id. If you enter a few letters and tab it will return a top ten list for you to choose from. Confirm the address in the display window to the right. Right click allows for copying of other parties. |

| Ship To Id | Enter ship to party id. If you enter a few letters and tab it will return a top ten list for you to choose from. Confirm the address in the display window to the right. Right click allows for copying of other parties. |

| Container Stuffing Location | Enter container stuffing location id. If you enter a few letters and tab it will return a top ten list for you to choose from. Confirm the address in the display window to the right. Right click allows for copying of other parties. |

| Consolidator | Enter consolidator party id. If you enter a few letters and tab it will return a top ten list for you to choose from. Confirm the address in the display window to the right. Right click allows for copying of other parties. |

| Booking Party | Enter booking party id. If you enter a few letters and tab it will return a top ten list for you to choose from. Confirm the address in the display window to the right. This field is ONLY used on isf 5. Right click allows for copying of other parties. |

| Misc | |

| Term Bond No. | |

| Term Bond Indicator | |

| Code Qualifier 1 | |

| Code Qualifier 2 | |

| IE or TE | |

| Place of Delivery | Enter place of delivery |

| Foreign Port Unlading | Enter foreign port code |

|

Button Name |

Description |

|

Ok |

Save and continue |

|

Create |

Create this ISF for CBP |

|

Cancel |

Exit without saving. |

ISF Misc

|

Field Name |

Description |

| Submit Entry No with ISF | Choose Yes to send entry number with ISF |

| Submit Master Bill | Choose Yes to send Master bill number with ISF |

| Carnet | Carnet number. Can be repeated 10 times |

| User Ref | User ref. Can be repeated 10 times |

| Surety Code | Surety code |

| Bond Ref No | Bond number from Surtey company |

| Full Name of ISF Importer | Full name of importer used with informals and by bond type 16 |

| Informal Shipment Details | |

| Shipment Sub Type | Informal entries require additional information. Choose submission type |

| Est Value | Enter estimated value |

| Est Qty | Enter estimated quantity |

| UOM | Enter Unit of Measure |

| Est Wgt K/L | Enter estimated weight and Kilos or Pounds |

|

Button Name |

Description |

|

Ok |

Save and continue |

|

Cancel |

Exit without saving. |

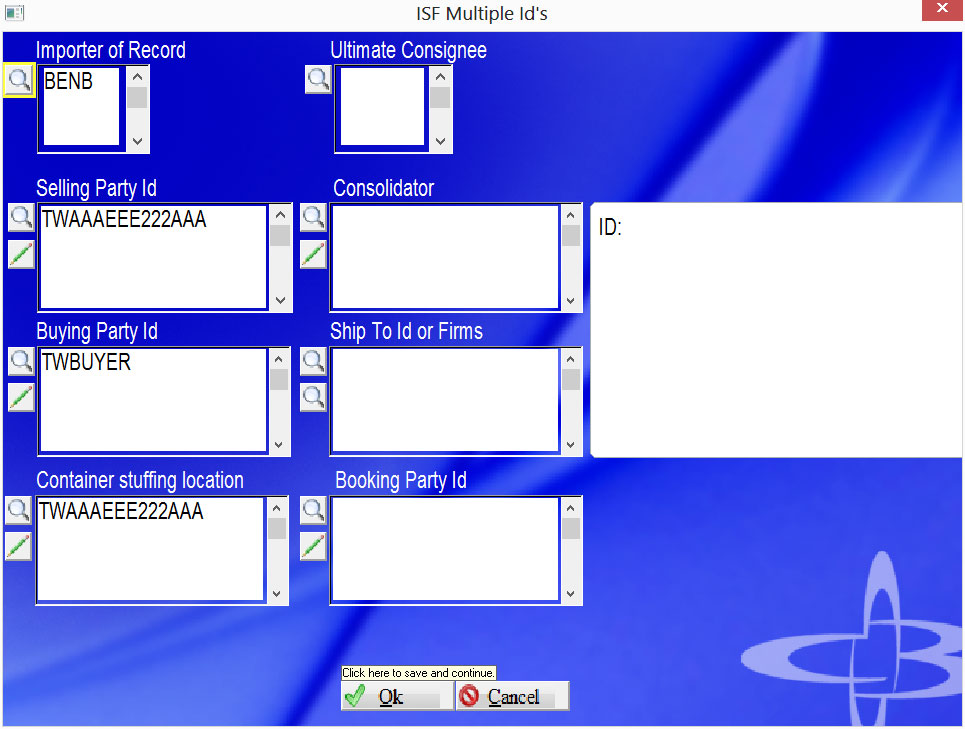

ISF Multiples

When multiple parties are involved enter them in their appropriate fields. Lookup and edit fields act the same as the first screen. Click Ok to save or Cancel to exit without saving.

|

Button Name |

Description |

|

Ok |

Save and continue |

|

Cancel |

Exit without saving. |

|

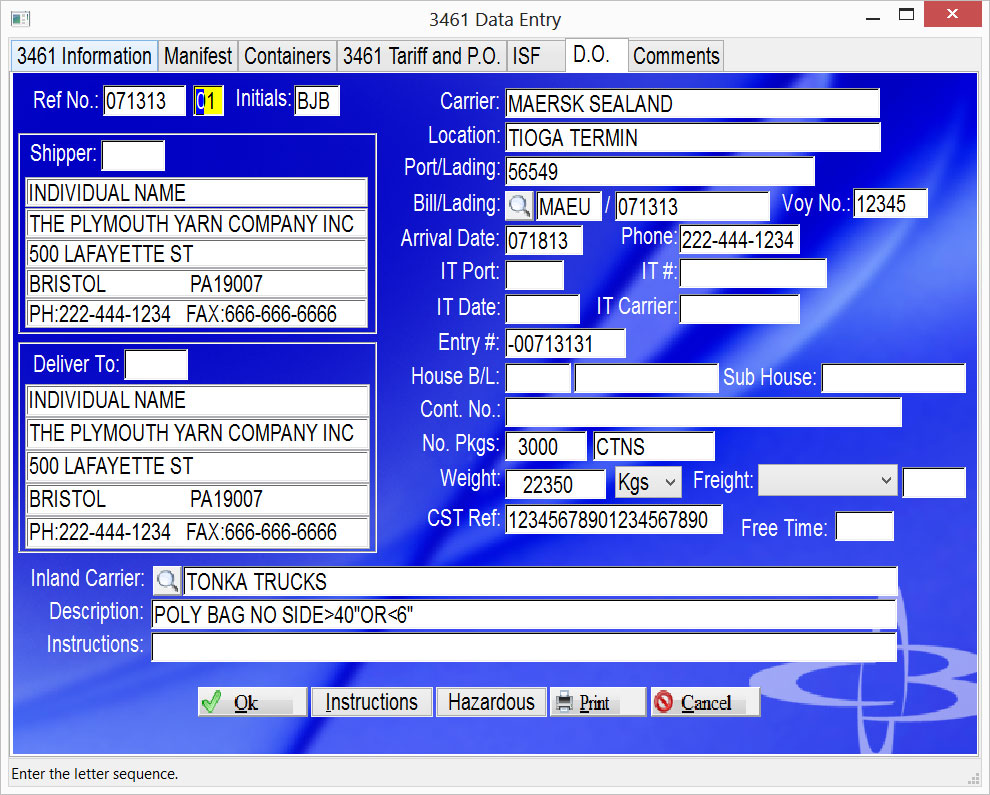

Summary |

This is for creating a delivery order for the Trucker or Importer. Most of this information should appear based on the entry previously being keyed. |

|

Field Name |

Description |

|

Ref No. |

|

|

Initials |

|

|

Shipper |

The shipper, will default the shipper as the person/company used in the Customer number. |

|

Deliver To |

This is the person/company to whom the goods are being delivered. You can Right Click on this field to lookup ship to address's or copy from shipper. |

|

Carrier |

This is the Ocean/Air Carrier Name of the transporter of the goods. |

|

Location |

This is the warehouse where the goods are being held. |

|

Port/Lading |

This is the Foreign Port of Lading (the Schedule K) |

|

Bill/Lading |

The Bill of Lading Associated with this shipment |

|

Voy No. |

|

|

Arrival Date |

A numeric date in MMDDYY (month, day, year) format representing the estimated date of arrival of the goods at the intended port of entry. The date is mandatory if certifying from entry summary |

|

Phone |

Contact phone number, should default your company number here. |

|

IT Port |

Enter a valid I.T. port. |

|

IT # |

|

|

IT Date |

Record the date (format MMDDYY) of the In Bond Entry Number (CF 7512) or if applicable, the Transit Air Cargo Manifest (TACM), or the AMS Master in-bond movement. Note: I.T. date cannot be prior to import date |

|

IT Carrier |

|

|

Entry # |

|

|

House B/L |

A code representing the house bill number, If this is used on an Ocean Shipment the House Issuer is required. |

|

Sub House |

A code representing the sub‑house bill number. |

|

Cont. No |

Enter this Specific container number. |

|

No. Pkgs |

Quantity of packages for this container. |

|

Weight |

Gross weight of the specific container. |

|

CST Ref |

Customer’s Reference number |

| Free Time | Last free time |

|

Inland Carrier |

|

|

Description |

|

|

Instructions |

|

|

Button Name |

Description |

|

Ok |

Click here to accept save and exit. |

|

Instructions |

Special Instructions for the trucker can be typed here. Default b/l info, cust ref, container data can automatically be imported to instructions screen. |

|

Hazardous |

Information regarding if the shipment contains Hazardous material. |

|

|

Click here to print this D.O. |

|

Cancel |

Exit without saving. |

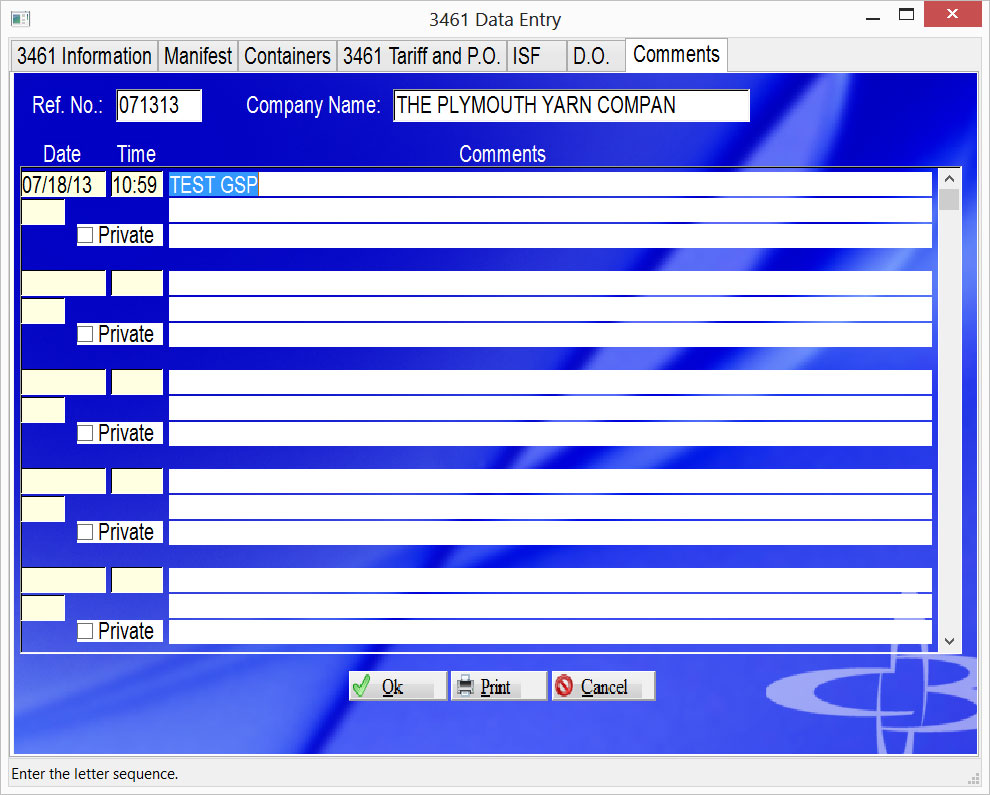

Comments

|

Summary |

This screen is for entering comments for this file, not the customer. The date and time will be entered after you key up to three lines of comments. Check Private if you do not want the comment to be uploaded to Webtracker. |

|

Field Name |

Description |

|

Comment |

|

|

Private |

Check here if you do not want the comment uploaded to webtracker. |

|

Button Name |

Description |

|

Ok |

Click here to accept save and exit. |

|

|

Click here to print these comments |

|

Cancel |

Exit without saving. |

Copyright © 2015 E.D. Bustard Inc.