| D30 Import Entry Record |

| D10 Header D11-12 Contract D20 Tariffs D25 Schedule B D40-41 Cert Mfg D50 Nafta D90 Summary |

|

Summary |

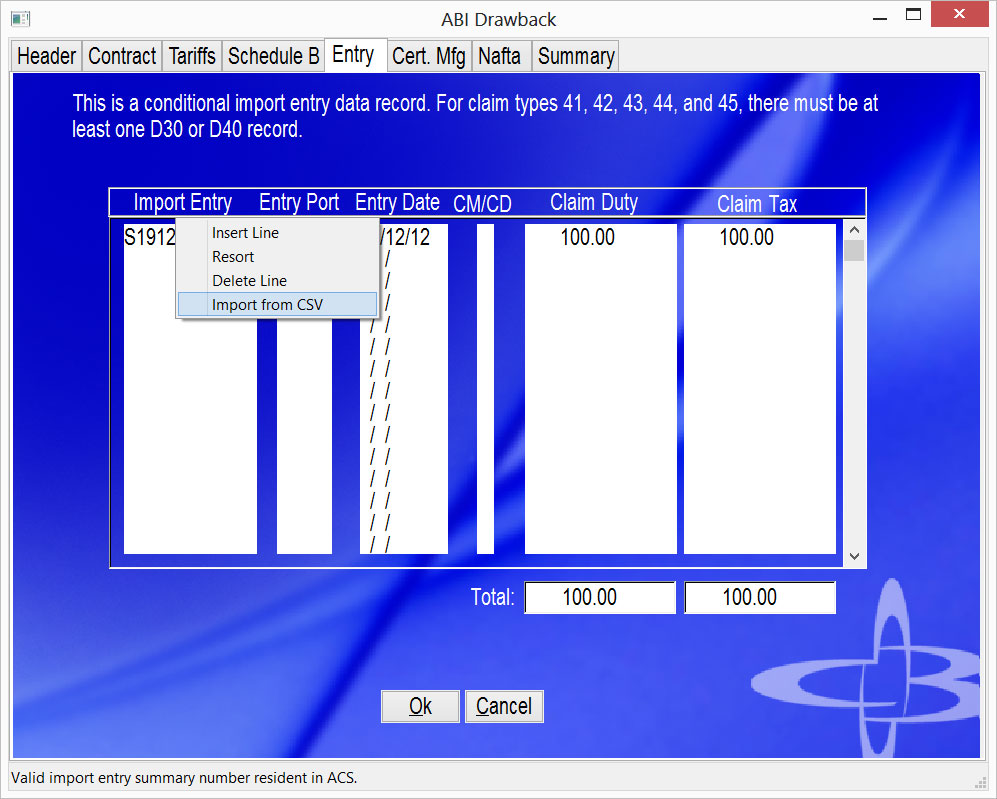

This is a conditional import entry data record. Up to 9,999 combined D30 and D40 records are allowed. For claim types 41, 42, 43, 44, and 45, there must be at least one D30 or D40 record. |

|

Field Name |

Description |

| Import Entry |

Valid import entry summary number resident in ACS. Right click options are shown in the image. Import from CSV is a simple but very useful way to get your data imported. |

| Entry Port | Valid district/port of the import entry. |

| Entry Date | Valid date in YYMMDD (year, month, day) format. This is an estimated import entry date. It does not have to be an exact match |

| CM/CD | Insert “E” if neither a Certificate of Manufacture (CM) nor a Certificate of Delivery (CD) was issued against the importation; “M” if a CM was issued; or “D” if a CD was issued. |

| Claim Duty | The actual amount of duty drawback claimed from this import entry. This is the net 99% of the claimable amount. Two decimal places are implied. |

| Claim Tax | The actual amount of tax drawback claimed for this import entry. This is 100% of the claimable tax amount. Two decimal places are implied. |

|

Button Name |

Description |

| Ok | Click to save and continue. |

| Cancel | Click to exit without saving changes. |

Copyright © 2015 E.D. Bustard Inc.