| Master Files - (4) Tariff Master Files |

|

Summary |

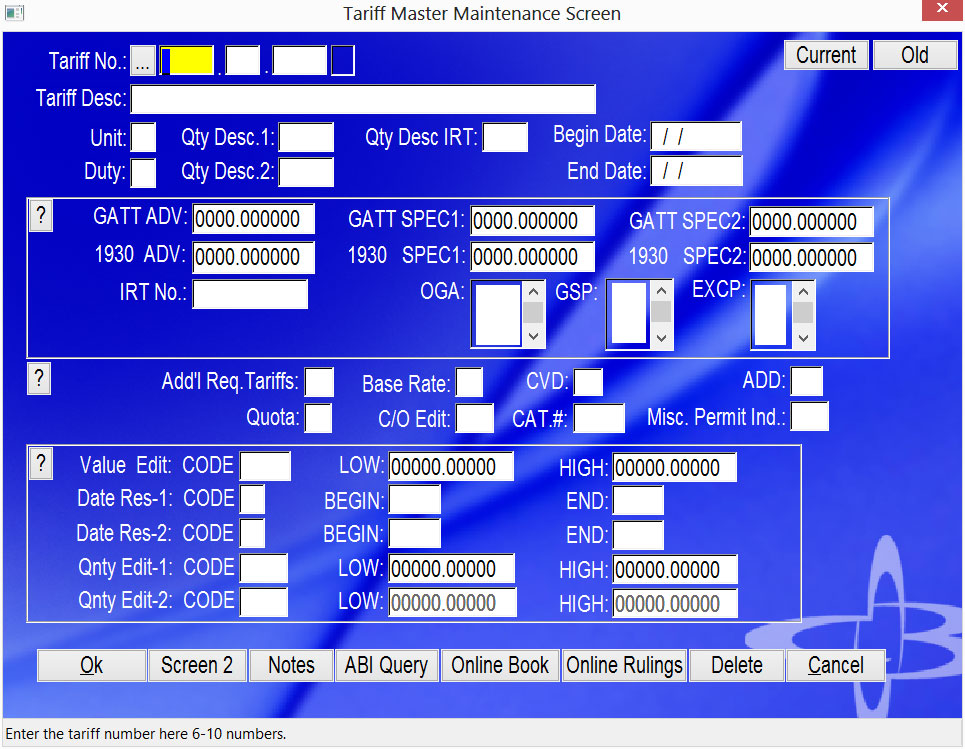

The tariff master is maintained with Abi tariff queries. However there are times when manual corrections need to be made. Special notice should be taken when editing tariff numbers to ensure that the Begin and End dates are correct. |

To edit the Tariff Master:

C.B.C.C. has the ability to runC.B.C.C. has the ability to run two tariff databases. At the end of the year Customs allows for special duty rates. Manual changes of the current and old tariff are used during this time. Click the Current button to see this year's tariff and click Old to see last year's tariff rates.

|

Field Name |

Description |

| Tariff No. | A code located in the HTS representing the tariff number. If this number is less than 10 positions, it is left justified |

| Tariff Desc. | A condensed version of the commodity description that appears in the HTS |

| Unit | Number of reporting units required by the Bureau of the Census. In a few instances, units not required by Census may be required to compute duty. In these cases, the Census reporting units are always first, followed by any additional units required to compute the duty |

| Duty | A code indicating the formula to be used to compute the duty |

| Qty Desc 1 | A code representing a unit of measure. If the reporting unit is X, no unit of measure is required except for certain tariff numbers in Chapter 99 |

| Qty Desc 2 | A code representing the second unit of measure |

| Qty Desc IRT | If Internal Revenue Tax is involved in the shipment |

| Begin Date | A numeric date in MMDDYY format indicating when the record becomes effective |

| End Date | A numeric date in MMDDYY format indicating the last date the record is effective |

| GATT ADV | The ad valorem rate of duty that appears in the General column of the HTS. Eight decimal places are implied |

| GATT SPEC 1 | The specific rate of duty appearing in Column 1 of the HTS |

| GATT SPEC 2 | The rate of duty appearing in the General column of the HTS that is not ad valorem or specific |

| 1930 ADV | The ad valorem rate of duty that appears in Column 2 of the HTS |

| 1930 SPEC 1 | The specific rate of duty appearing in Column 2 of the HTS |

| 1930 SPEC 2 | The rate of duty appearing in Column 2 of the HTS that is not ad valorem or specific |

| IRT No. | Internal Revenue Tax number |

| OGA | Codes that indicate special requirements by other Federal Government agencies must or may apply |

| GSP | Generalized System of Preference. Codes indicating countries eligible for preferential treatment |

| EXCP | Countries excluded from Generalized System of Preferences. For excluded countries, code is A |

| Add Req Tariffs | Code indicating if an additional tariff number may be required with this tariff number |

| Base Rate | Code indicating if the rate contains a base rate |

| CVD | Countervailing Duty Flag. A code of 1 indicates the tariff number is subject to countervailing duty |

| ADD | Antidumping Duty. A code of 1 indicates the tariff number is subject to an antidumping duty |

| Quota | A code of 1 indicates the tariff number may be subject to quota |

| C/O Edit | Country of Origin (from ISO). Code of 01 indicates C/O is eligible for column 1 duty rate; code of 02 indicates C/O is eligible for column 2 duty rate |

| CAT # | Category number. Code indicating textile category assigned to tariff number |

| Value Edit | LOW: HIGH: Code representing value edit |

| Date Res-1 | Code representing first entry date restriction. Begin End: Numeric date in MMDD format representing the first begin/end restriction dates used in the edit |

| Date Res-2 | Code representing second entry date restriction. Begin End: Numeric date in MMDD format representing the second begin/end restriction dates used in the edit |

| Qnty Edit 1 | Code representing first quantity edit. Low High: Value representing minimum (lowest)/maximum (highest) quantity edit |

| Qnty Edit 2 | Code representing second quantity edit. Low High: Value representing minimum (lowest)/maximum (highest) quantity edit |

|

Button Name |

Description |

| Ok | Click here to save changes Exit. |

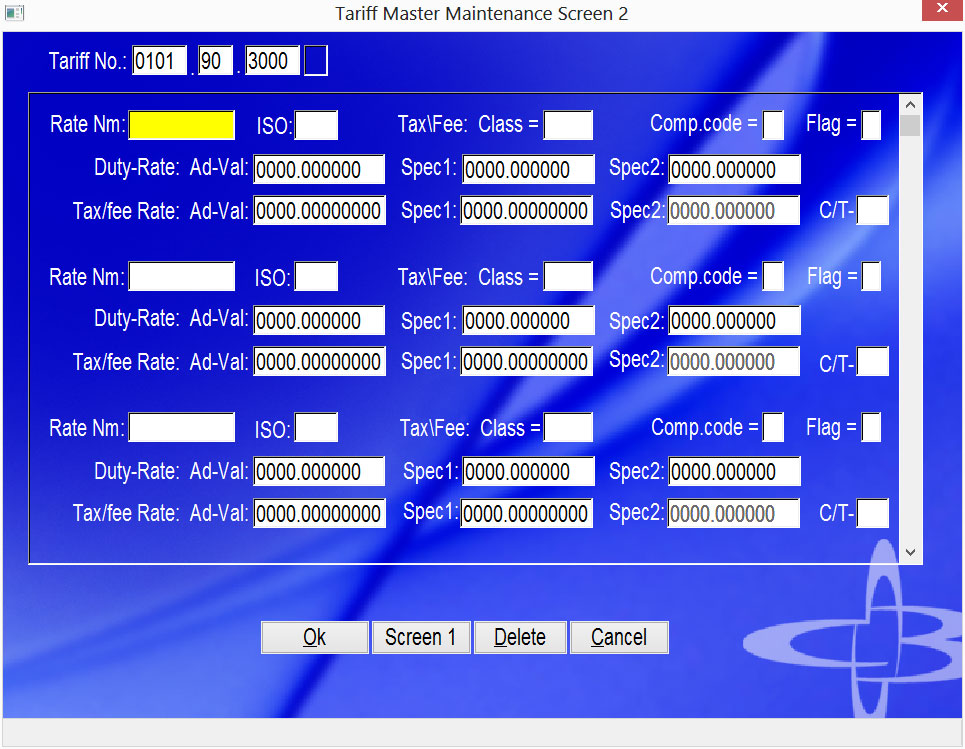

| Screen 2 | Screen 2 has additional special rates. See below for more details. |

| Cancel | Click to exit without saving. |

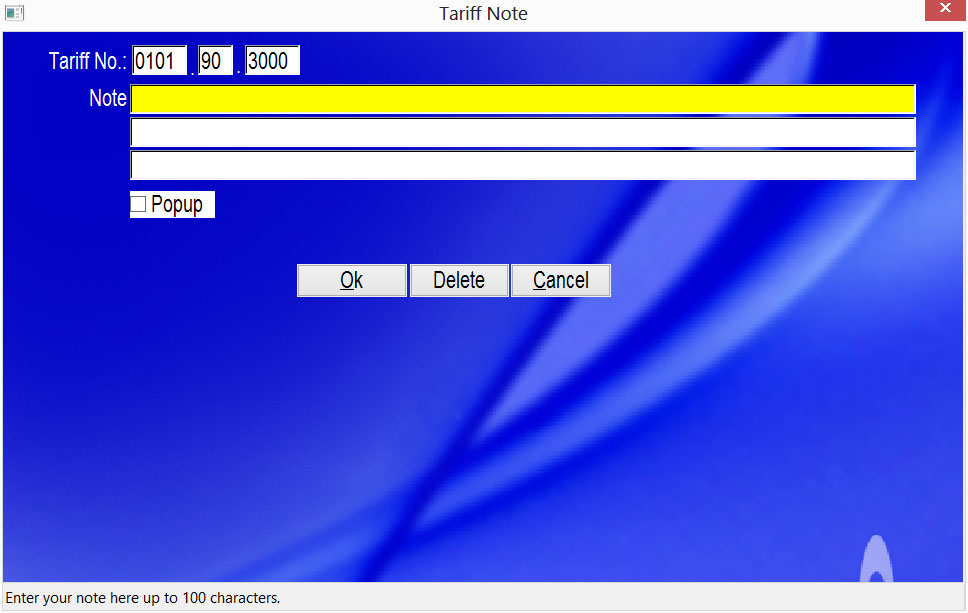

| Notes | The Notes button allows for special notes that will pop up when keying entries. |

| ABI Query | Click here to open ABI tariff query program. |

| Online Book | This button should open your default browser to the customs online tariff database. |

| Online Rulings | This button should open your default browser to the Customs Ruling website. |

| Current | Click current to use this years tariff base in your search. |

| Old | Click old to use last years tariff base in your search. |

| Delete | Click here to delete this tariff. Most tariff maintenance should be done with the tariff maintenance program. |

| Cancel | Click to exit without saving. |

|

Field Name |

Description |

| Tariff No. | A code located in the HTS representing the tariff number. If this number is less than 10 positions, it is left justified |

| Rate Nm: | IRS tax rate |

| ISO | Code representing the country |

| Tax\Fee Class | Code representing the tax/fee class |

| Comp Code | Code indicating first tax/fee computation formula |

| Flag | Code indicating tax/fee is required (1) or may be required (2) |

| Duty Rate | Specific rate of duty required to compute taxes and/or fees |

| Ad-Val | Ad Valorem rate of duty required to compute taxes and/or fees |

| Spec 1 | Specific rates if given by the system |

| Spec 2 | Additional specific rate if given by the system |

| Tax Fee Rate | IRS or cotton fees |

| Ad-Val | Ad valorem rate of duty required to compute taxes and/or fees |

| Spec 1 | Specific rate of duty required to compute taxes and/or fees |

| Spec 2 | Additional specific rate as needed |

| C/T |

|

Button Name |

Description |

| Ok | Click here to save changes Exit. |

| Screen 1 | Click current to use this years tariff base in your search. |

| Delete | Click here to delete this tariff. Most tariff maintenance should be done with the tariff maintenance program. |

| Cancel | Click to exit without saving. |

|

Field Name |

Description |

| Tariff No. | A code located in the HTS representing the tariff number. If this number is less than 10 positions, it is left justified |

| Note | Three free format lines for notes. This will pop up when keying entries if you check the popup box. |

|

Button Name |

Description |

| Ok | Click here to save changes Exit. |

| Delete | Click here to delete this note. |

| Cancel | Click to exit without saving. |

Copyright © 2015 E.D. Bustard Inc.